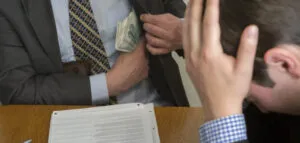

California White Collar Crimes Attorney

Hire A White Collar Crime Attorney With Proven Results

If California officers have arrested you for white-collar crimes, you stand to spend many years in jail or prison. You’ll be away from your family during those times—missing special holidays and birthdays. What’s more, incarceration will derail many of your dreams. It can even lead to a divorce if you’re married and cause child custody issues if you’re a parent. Fortunately, help is available.

Consider consulting with a California financial crimes lawyer as soon as you know of any investigation into you or charges that have been filed against you, whether in state or federal court. My Rights Law has experienced white-collar criminal defense lawyers who can explain your legal rights and options and defend you against these charges. Contact us by completing our secure web form today or call (888) 702-8845 for a free case consultation.

Common White-Collar Crimes

White-collar crimes can be state or federal offenses. Regardless of whether the state or federal government brings the case against you, these crimes can devastate your life if you’re found guilty. Your situation may worsen if prosecutors bring multiple white-collar crimes against you. The state can charge you with several white-collar offenses because some are closely related. If this happens and a judge decides to sentence you to consecutive terms, you’ll serve one sentence after another, prolonging your stay.

You may wonder which crimes fall into this category. Below is not an exhaustive list, but it contains common crimes that state and federal law consider white-collar crimes. We’ll expand on some of them later in this article.

- Forgery

- Tax evasion

- Counterfeiting

- Wire fraud

- Illegal gambling

- Embezzlement

- Extortion

- Money laundering

- Health care fraud

- Insurance fraud

- Bank fraud

- Securities fraud

Forgery P.C. – Penal Code 470

Penal Code 470 criminalizes intentionally passing off fraudulent documents as real when you know them to be fake, altered, or forged. Whether you sign for someone else without their authority, sign the name of a fake person, or publish any document with the intent to commit fraud, a prosecutor may file this charge against you. Note that documents can be anything that can help you defraud a person, franchise, or bank out of their rightfully held property, including:

- Bank notes

- House notes

- Car notes

- Checks

- Money orders

- Traveler’s checks

Penalties

The state may charge you with misdemeanor or felony forgery. If a jury convicts you of a misdemeanor, you could face one year in jail. If you’re convicted of a felony, you could face as many as three years behind bars.

Defenses

Which defenses are applicable turn on the specifics of your unique case. Some defenses are viable in one scenario but not in another because there are many ways to commit forgery. It’s best to consult with a knowledgeable forgery lawyer to learn more.

26 U.S.C. § 7201 Tax Evasion

Under 26 U.S.C. § 7201, you commit tax evasion whenever you willfully use illegal means to avoid paying your taxes. For example, you may lie about whether your C Corp taxable business distributed income to its shareholders or retained it in the business. You may lie about your business’ income to reduce the taxes you must pay to the Internal Revenue Service. Sometimes, you may exaggerate the cost of your tax deductions to owe the IRS less. Any time you purposely and intentionally try to avoid paying the government what you owe, you’re committing a serious crime.

Penalties

This felony is always a federal offense and is punishable by up to five years in prison or a fine of up to $100,000. You might have to pay up to $500,000 in fines if you’re a corporation.

Defenses

Mistake Of Fact

You may argue that you didn’t know a certain term covered a monetary amount that you should’ve included on your tax form. On the other hand, you may have misinterpreted something to think that you didn’t need to report certain information or that you could use an activity as a charitable deduction when, in fact, you couldn’t. These instances are called “mistakes of fact.” It occurs when you know you must do something but misunderstand all the facts or duties the obligation entails.

Good-Faith Mistake

You likely made an honest mistake and reasonably believed that the numbers you reported to the IRS were accurate and true. Whether your paperwork was mixed up, someone gave you the wrong numbers, or your tax preparer erred, you can raise this defense.

Counterfeiting P.C. – Penal Code 475

It is illegal to knowingly possess or receive counterfeit checks while intending to use them to defraud someone or to complete the act of altering the checks, according to Penal Code 475. Under this statute, you may not knowingly possess an incomplete check or monetary device (e.g., money order, traveler’s check, bank bill) with the intention to complete it so you can defraud someone.

Please note that it doesn’t affect your case whether the check is real or fake. A prosecutor will charge you the same way, regardless.

Penalties

Counterfeiting is a type of forgery crime as well as a white-collar crime. When a court finds you guilty of this offense, it finds you guilty of forgery. Misdemeanor forgery is punishable by up to one year in jail. Felony forgery is punishable by sixteen months, two years, or three years behind bars at the judge’s discretion.

Defenses

Whenever the state accuses you of a crime, it’s advisable to tackle the elements of that crime’s statute. The elements of a crime are what prosecutors must prove for a jury to find you guilty.

Not Knowingly

In this case, you could argue that you didn’t knowingly possess counterfeit checks. Suppose a friend gave them to you and asked if you could deposit them for her because she didn’t have time to stop by the bank before work. You had no reason to suspect that your friend was doing something criminal.

No Intent To Defraud

If you passed off bad checks under duress or unknowingly, you couldn’t have had the criminal intent required for the crime. You didn’t intend to defraud the state. Rather, you could’ve been forced to deposit the forged checks under threat of personal harm, or you did so unaware that someone forged the checks.

Illegal Gambling P.C. – Penal Code 330

That gambling can be a crime may come as a shock considering California has some of the best casinos in the country. However, it’s indeed illegal to gamble under some circumstances. California’s Penal Code 330 criminalizes gambling when you take any action as an owner or employee (such as opening, playing, helping the illicit game to be carried on) to play any banking or percentage game using a device, such as cards or dice to acquire anything of monetary value like real property, cash, or checks.

Penalties

Gambling with friends may seem harmless, but it’s actually a misdemeanor offense. Suppose you and your friends conduct an illegal gambling ring in your basement every Thursday. Someone tips off the police. The police come to your home and arrest everyone there. Should you decide to plead guilty or suffer a guilty verdict at trial, you could face up to six months in jail. A judge can also order you to pay a fine from $100 to $1,000.

Defenses

Fortunately, there are viable defenses for every crime, and you’ll want to use them. Don’t assume that misdemeanors are not significant enough to contact a lawyer about. You’ll want a strategic lawyer to get you out of any situation that can give you a criminal record because this record can come back to haunt you when you least expect it.

One defense you may use is to argue that the game never involved winning anything of value. Remember that a gambling ring has to operate with the purpose of the players receiving money or something with monetary value. If you and your friends play card or dice games but don’t play for real money (i.e., you play with paper money instead), that’s hardly a crime.

Federal White-Collar Crimes

White-collar crimes tried at the federal level (cases brought by the United States Attorney’s Office) tend to have lengthier sentences and more significant monetary penalties. The penalties for these violations of federal laws vary across the board, but we’re just as equipped to help to fight against federal-level charges as we are against state-level charges. If you are also up against serious federal charges, contact us immediately.

Choose An Acclaimed Law Firm With Passion

You need an experienced law firm where criminal defense attorneys fight aggressively for you whenever you’re facing criminal charges at risk of having your liberty stripped away. My Rights Law is that firm. And with a well-documented record of case victories, you know you’re in good hands when you choose us. We promise to fight just as passionately for you as we have for all our satisfied clients, so don’t wait any longer. Call our white collar crime attorneys for a confidential, free consultation now at (888) 702-8845 or leave us a message on our secure web form.

Other financial crimes we defend include: Calfresh food stamps fraud, RICO fraud