California Mortgage Fraud Lawyer

How Can a Mortgage Fraud Attorney Help Me?

If the state has arrested you for mortgage fraud, it’s time to speak with knowledgeable financial crimes lawyer. California mortgage fraud attorneys can prevent you from losing many years of your life to the penal system. But don’t put your freedom in the hands of any law firm. Instead, choose My Rights Law. We have the case victories and client testimonials to prove that your odds are better with us. Don’t wait. Call us now at (888) 702-8845 or reach out through our secure web form to take advantage of your free first consultation.

Mortgage Fraud As A California State Offense

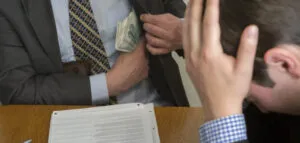

California Penal Code 532 criminalizes mortgage fraud. Mortgage fraud occurs when you deliberately misstate, misrepresent, or omit a material fact to a necessary party in the mortgage process or when you receive money from a fraudulent mortgage process that you know to be fraudulent. A “material fact” is one that the other (or parties) rely on to make an important decision.

Penalties

Mortgage fraud is a wobbler, meaning prosecutors have the discretion to charge you with a misdemeanor or felony. If a jury convicts you of a misdemeanor, you could face a maximum of one year in jail or one year of probation. However, if it’s a felony charge, you may face as many as three years in prison or on probation. The court can also order you to pay fines. Not to mention, the victim may bring a civil case against you to recover compensatory and punitive damages. California doesn’t have a cap for punitive damages. Thus, you may have to fork over an excessive amount.

Defenses

Mistake Of Fact

This defense applies when you were mistaken about a material fact. If so, this makes your false statement unintentional and accidental at best. If you genuinely believed what you said and stated it in good faith, you didn’t have any criminal intent. You can prove you genuinely believed what you said was true by referencing documents, even if they’re outdated (e.g., perhaps you never saw or received the updated document). You may prove a genuine, good-faith mistake by comparing what you said to what is standard practice or common in the local community.

No Reliance

If the victim didn’t rely on your statement in making their decision, you might argue that fraud didn’t occur. Your deceit was a non-factor to the victim, meaning they wouldn’t likely make the same decision regardless of your statement. If the victim didn’t believe or rely on your statement, you might argue that no deceit occurred.

Why Are You Under Investigation?

Law enforcement is often notified about possible mortgage fraud through suspicious activity reports (S.A.R.s) filed by financial institutions or miscellaneous government offices. Red flags that may start an investigation include:

- Foreclosure of a property

- Filing for bankruptcy

- Fraudulent appraisals

- False mortgage loan application

- Forgery [1]

- False reporting of income, financial fraud[2]

- Suspiciously high or fraudulent commissions

- Higher than normal fees

- Legal guidance is given by non-lawyers, misrepresentation

- Buying loans masked as refinance

- Numerous holding companies used to increase property values

In California, mortgage fraud investigations look at bankers, brokers, mortgages, and loan officers. Because statistics drives many prosecution offices, some prosecutors play a numbers game, filing several easy-to-prove small cases rather than large cases against those who have done the most harm.

Not everyone who exaggerated the value of their home will be prosecuted. However, individuals who provided or prepared false employment documentation or other similar documentation to support a loan application are far more likely to be charged. Suppose you are the target of a state or federal investigation or have been charged with mortgage fraud. In that case, you may wish to have a California mortgage fraud defense attorney who can aggressively defend you.

Our experienced criminal defense attorneys have defended people accused of financial crimes for years. We are familiar with the operations of the financial industry. We represent bankers, brokers, buyers, and sellers charged with mortgage fraud/loan fraud. We have the experience and talent. We know the prosecution’s goals and how this may be used to your advantage. Contact us online or call (888) 702-8882 to schedule a free consultation today.

Mortgage Fraud As A Federal Offense

There is not a specific federal law against mortgage fraud. However, there are federal laws against different types of fraud that may correspond with mortgage fraud. An attorney general may charge you with mail fraud, bank fraud, or both if you’re suspected of mortgage fraud. Both are egregious crimes that can follow you long after you’ve served your time. For that reason, you’ll want to speak with federal criminal defense lawyers if you face any federal offenses relating to mortgage fraud.

Mail Fraud

18 U.S. Code § 1341 is the federal statute on mail fraud. Whoever intentionally or attempts to scheme or defraud someone by depositing deceptive information in the mail violates this law. For example, you cannot put a letter, money, contracts, or anything of value into the United States Postal Service to further fraudulent schemes. Your mail doesn’t need to travel from one state to another for an attorney general to bring this charge against you. You’re automatically involved in interstate travel because you’re communicating through the postal service. Here, mailing a mortgage borrower or lender a deceptive contract or false paperwork is punishable under this statute.

Mail Fraud Penalties

A mail fraud conviction can lead to twenty years in federal prison. Other penalties include:

- Career loss

- Real-estate license loss

- Missed time with family and loved ones

Mail Fraud Defenses

You may use the same defenses for a federal charge as a state charge. You can apply the same defenses because both crimes involve intent and deception. Therefore, proving that you didn’t intend to defraud or didn’t intend to make a false statement are strategies that may preserve your freedom. However, mail fraud differs slightly from mortgage fraud, so other defenses can apply.

In this case, you can argue that you didn’t use the postal service. However, if fraud is present, this defense may only result in a lighter sentence or lesser charge than a complete defense. Under some circumstances, a fourth amendment violation can be used to suppress damning evidence or get a dismissal. A Fourth Amendment violation happens when a government agent, like an officer, seizes or searches your property without a warrant. Officers need probable cause to get a warrant to search your property, such as your home, where they may find proof of fraudulent paperwork used in the mortgage fraud process.

All About Bank Fraud

Under 18 U.S. Code § 1344, you can’t knowingly or attempt to defraud a financial institution or use fraud to get any monetary value from that institution. If convicted, you could serve up to thirty years in prison, pay up to $1,000,000, or both. Bank fraud can apply to your mortgage fraud case if you cashed fraudulent checks or used the fraudulent mortgage process to get money from a bank you know you obtained illegally. As mentioned above, you can use lack of intent, duress, and false allegation as defenses, among others. Of course, speaking with a seasoned mortgage fraud defense attorney is always best to develop the most suitable strategy for your case.

Experienced California Criminal Defense Lawyer

The experienced mortgage fraud lawyers at My Rights Law are here for you if you are facing mortgage fraud charges. Our lawyers have experience in mortgage fraud cases, including real estate fraud and financial institution fraud. Frequently, we can settle a case resulting in no charges being filed, a dismissal, or a lessening of charges. Call (888) 702-8845 or leave a message on our secure web form today for a free consultation.

Other financial crimes we defend include: Insurance Fraud, Securities Fraud

FOOTNOTES

[1] California Civil Code 2945.4

[2] Black’s Law Dictionary, sixth edition