California Money Laundering Attorney

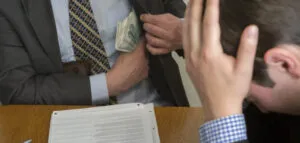

Do You Need A Money Laundering Attorney?

Money laundering isn’t a crime that only career criminals, professionals, or organized crime members commit. An everyday person can commit this offense. Money laundering is a state offense and a federal offense. Prosecutors usually charge you with one over the other. However, an attorney general may charge you in California and federal court. As you can imagine, the potential penalties are disastrous. Therefore, you may wish to consult the experienced California financial crime lawyers at My Rights Law if you are charged with money laundering. We’ll explain which defenses or plea deals might be available in your case. Call us at (888) 702-8845 or leave us a message on our secure web form to receive your confidential free case consultation.

Money Laundering As A California State Offense

California penalizes money laundering under Penal Code 186.10. According to this statute, you are guilty of this offense if:

- During a seven-day period, you deposit or try to deposit unlawfully obtained money into at least one bank.

- During a thirty-day period, you deposit or try to deposit money obtained unlawfully into at least one bank.

- You do this to further, promote, manage, establish, or continue criminal activity.

- You deposit the money when you know it’s directly or indirectly the result of illegal activity.

If the state accuses you of doing this during the seven-day window, the amount must be $5000.01 or more.[1] The amount must be more than $25,000 if the state accuses you of laundering over thirty days. [2]

Penalties

This crime is a wobbler. Wobblers are crimes that prosecutors may charge as misdemeanors or felonies. Typically, it is a misdemeanor if the property was worth less than $50,000.

A judge can sentence you up to one year for misdemeanor money laundering. However, the court can (and most likely will) bring separate charges against you for each unlawful deposit. In other words, if you deposit eight checks derived from criminal activity, the judge can multiply your sentence by eight. One year turns into eight. The judge can also order you to pay $250,000 or double the value of the money you laundered. By law, the judge will order you to pay the higher amount.[3]

This crime is subject to enhancements.[4]

Laundering $50,000 to $150,000 = felony punishment of one more year.

Laundering $150,000 to $1,000,000 = felony punishment of two more years.

Laundering $1,000,000 to $2,500,000 = felony punishment of three more years.

Laundering more than $2,500,000 = felony punishment of four more years.

Who Can Be Sued In Civil Money Laundering Lawsuits?

Money laundering is not only a criminal offense, but these perpetrators can also be held civilly responsible:

- People: The government could file a civil lawsuit for the value of cash or property.

- Monetary Institutions: The Department of Justice also has the ability under money laundering regulations to seek civil lawsuits versus financial institutions even though they might not have been charged with money laundering, so long as the case is based on allegations that employees laundered money and seeks recovery of the amount of money laundered.

Defenses

Now that you know California takes this crime lightly, you understand the importance of hiring a skilled attorney. Contacting us offers you a better chance of knowing what you’re up against and which defenses are at your disposal. One of our attorneys will analyze the facts particular to your case and see which defenses may apply. We include a few common defenses to money laundering below.

Mistaken Identity

Typically, banks have cameras all over their premises. When the state accuses someone of money laundering, there’s often video evidence due to the camera catching the perpetrator. But cameras can be grainy, and a witness may identify the wrong person (i.e., a “look-a-like”). The real perpetrator may even set it up to make it seem that you committed the crime by making themselves look like you or planting evidence on you.

Involuntary

Someone may have forced you to commit this crime on their behalf by threatening or harming you. Suppose a person pummeled you until you deposited illicit checks for them. Suppose the mastermind sent you threatening pictures and messages for months until you caved in and did what you were told. In either instance, there’s a good chance you can argue you acted under duress. If you acted under duress, you did not voluntarily consent to commit the crime.

Lack Of Criminal Intent

Money laundering is considered a specific intent crime. Specific intent is your state of mind when you committed the crime. It requires committing an illegal act and doing so with a subjective intent or goal.

Specific intent crimes are typically indicated by using such phrases as “intentionally,” “knowingly,” “purposely,” or “willfully.” If you did not act with the required intent, a jury should find you not guilty. An instance of this would be if your acts were part of an innocent joke.

Money laundering is also a general intent crime. Thus, an attorney general must prove you acted with the intent to deprive the owner of their property permanently.

The primary distinction between specific and general intent crimes is each crime’s “actus reus” and “mens rea” elements. Specific intent crimes mean that the perpetrator must desire to commit the act and an intent to achieve a particular result. On the other hand, general intent crimes need the defendant to commit a criminal act per the law. Thus, you could be convicted merely by committing a general intent crime.

Without intent, the charges shouldn’t stick. Therefore, you may receive a dismissal, acquittal, or other positive outcomes if you prove you lacked criminal intent. A few ways to prove you lacked criminal intent is to show that you acted under duress, committed the offense(s) while sleepwalking,[5] or suffered from a mental condition that disables you from distinguishing right from wrong.

Money Laundering As A Federal Offense

Money laundering is a federal offense under 18 U.S. Code § 1956. Laundering was made a federal crime effective 1986 under the Money Laundering Control Act. You violate this federal law when you, knowing the money involved in the transaction stems from illegal means, attempt to cash it at a financial institution or otherwise launder money through a different financial transaction. It’s unlawful to do so in hopes of concealing the crime’s source, location, or mastermind or to do so to avoid paying the government. This statute also criminalizes transporting or transferring funds within or outside the United States for criminal purposes. The federal government prosecutes federal money laundering charges through the United States Attorney’s Office.

Penalties

If a jury convicts you of a money laundering scheme, prison sentences vary. Depending on the facts of your charges, the judge may sentence you up to ten years or up to twenty years. Under some subsections of this statute, the judge may order you to pay up to $10,000 or up to $500,000. A court can also issue a restraining order against your bank accounts to prevent further illicit activity. It can issue this order during the pre-trial phase.

Defenses

The defenses you would use in state court can apply in federal court, but here are other defenses to add to the list.

Inaccurate Warrant

Generally, warrants are needed if the police want to search your home. Warrants must be specific. Thus, the document must describe what evidence the police expect to find and where they expect to find it. For example, if the police obtain a warrant to search your house, but the evidence is in your car, they cannot use that warrant to search your vehicle. Also, the warrant must accurately print and spell your name and address. If even one letter is off, the warrant is no good. An insufficient warrant means the court must suppress any evidence the police obtained unless an exception applies or the police can prove that they wouldn’t get the same evidence anyway.

Fourth Amendment Violation

Our Constitution guarantees you the right to be free from unreasonable searches and seizures where there’s no warrant. This right is only nullified when an exception applies. Otherwise, the police must have probable cause to get a warrant to search your property. Officers have probable cause when the totality of the circumstances would lead a reasonably situated person (to the officers) to believe that you committed the crime. If officers obtain evidence by violating this right, you can request the court to suppress the illegally gathered evidence. If the court agrees, this increases your chances of a favorable outcome.

California Attorney To Defend A Money Laundering Accusation

Money laundering is a wobbler, meaning it can be charged as either a misdemeanor or a felony.[6] If you are being charged with money laundering, you may wish to consult our experienced California money-laundering lawyers as soon as possible. My Rights Law criminal defense lawyers may tell you what defenses against money laundering might be available in your case. Our attorneys may help fight for you in court if necessary. Contact us by completing our secure web form today or call us at (888) 702-8845 for a free case consultation.

Other financial crimes we defend include: Identity Theft, Insurance Fraud

FOOTNOTES

[1] See CA PC 186.10(a)

[2] See the footnote above

[3] See the footnote above

[4] See CA PC 186.10(c)(1)

[5] See Sleeping in People v. Reiz

[6] California Penal Code 186.10 PC